The world economy currently runs on oil, a resource controlled by our enemies. This threatens to leave us prostrate. It must change — and it can change, quickly.

Saudi Arabia is the primary global financier of the Islamist terror cult. Until the Saudis started racking up billions in inflated oil revenues in the 1970s, the Wahhabi movement was regarded by Muslims the world over as little more than primitive insanity. Without rivers of treasure to feed its roots, this horrific movement could neither grow nor thrive. It is the Saudis’ unlimited funds — over $200 billion in foreign exchange earnings in 2006 — that have allowed them to buy up the faculties of the Islamic world’s leading intellectual centers; to build or take over thousands of mosques; to establish thousands of radical madrassas, pay their instructors, and provide the free daily meals necessary to entice legions of poor village boys to attend. Those boys are indoctrinated with the idea that the way to get into paradise is to murder Christians, Jews, Buddhists, Taoists, and Hindus (not to mention moderate Muslims). Graduates of these academies are today killing American soldiers in Iraq. Meanwhile, Arab oil revenues have underwritten news outlets that propagandize hatefully against the United States and the West, supported training centers for terrorists, paid bounties to the families of suicide bombers, and funded the purchase of weapons and explosives. We have been subsidizing a war against ourselves.

And we have not yet reached the culmination of the process. Iran is now using its petroleum lucre to fund its nuclear program and to insulate itself from economic sanctions imposed on it. Once produced, Iranian nuclear weapons could be used by the Iranian regime itself or be made available to terrorists to attack U.S., European, Russian, or Israeli targets. This is one of the gravest threats to international peace and stability — and, again, we are paying for it ourselves with oil revenue.

Our responses to these provocations have been muted and hapless because any forceful action on our part against nations like Saudi Arabia and Iran could result in the disruption of oil supplies that the world economy is utterly dependent upon. We cannot stand up to our enemies because we rely upon them for the fuel that is our economic lifeblood. We pay them for their oil and they make war on us.

In light of these realities, U.S. energy policy for the last three decades has been a scandal. The time has come for change. To liberate ourselves from the threat of foreign economic domination, to destroy the economic power of the terrorists’ financiers, and to give ourselves the free hand necessary to deal forcefully with them, we must devalue their resources and increase the value of our own. We can do this by taking the world off the petroleum standard and putting it on an alcohol standard.

The Cartel and Its Levers

To understand how we can break away from oil, we must first understand the workings of the Organization of the Petroleum Exporting Countries (OPEC), the cartel arrangement that has fabulously multiplied the Saudis’ petroleum revenue stream and the power that goes along with it. Founded in 1960, OPEC is an open conspiracy in which representatives of the rulers of a dozen kleptocracies (Algeria, Angola, Indonesia, Iran, Iraq, Kuwait, Libya, Nigeria, Qatar, Saudi Arabia, the United Arab Emirates, and Venezuela) get together at periodic meetings and decide what the world price for oil should be, and then assign production quotas to each so as to force the price to that level. This is very different from the way business is conducted in a free market, and it produces very different results.

In a 1999 speech, Saudi oil minister Ali al-Naimi told the Houston Forum that his country’s “all-inclusive” cost of producing petroleum was $1.50 per barrel, and its cost for discovering new reserves about $0.10 per barrel. Worldwide, the average cost of finding and producing a barrel of oil is about $5, and the most expensive oil currently being marketed in any serious quantity in the world today costs no more than $15 per barrel to produce. As recently as 1999, the sales price of oil was as low as $11 per barrel, implying that production costs were lower still — and those costs certainly have not increased by more than 40 percent since.

As veteran commodities trader Raymond J. Learsy explains in his 2005 book Over a Barrel,

In normal commodities markets, sellers would start [with the production cost], add the infrastructure cost and the expense of transporting and marketing the goods, and take a profit, which would be determined by competition with other producers. In a totally rational world, the world’s cheapest oil would be used up first, and customers would turn to more costly sources when the least expensive ones dried up. In effect, this is what the Seven Sisters [the major oil companies that dominated after the breakup of Standard Oil] did when they controlled the market [in the mid-twentieth century].

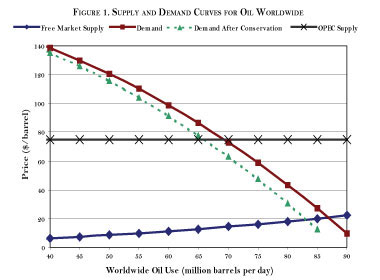

That is certainly not how it works today. To see the difference, look at Figure 1. Here I have drawn reasonable guesses for the supply and demand curves for oil. (All supply and demand curves are guesses — no one really knows in advance exactly how much of a given product might sell at some other price than the current one.) The curve with the diamonds is supply; it goes up with price as more producers can do business profitably. The curve with the squares is demand; it falls with price as less oil can be sold when it costs too much. The place where they cross is where buyers and sellers agree, and thus is the free market price. In this case, with the assumed data, the free market price comes out to about 87 million barrels per day selling worldwide at a price of $20 per barrel. Most traders would agree that this is close to the right number for the free market price of oil today, and in fact, it was the going price as recently as 2002.

|

NOTE: Values shown are reasonable guesses selected for explanatory purposes, not necessarily corresponding to real data. Click the image to enlarge. |

However, functioning as a cartel, OPEC can survey the demand curve and simply decide where to intersect it. If OPEC’s members want a price of $75 per barrel, all they have to do is draw a line horizontally across the chart (as shown) to see that they can obtain that price by limiting worldwide production to 72 million barrels per day. To be sure, as a result of such action, oil-hungry customers who would have purchased those 15 million barrels every day will have to do without, but the OPEC members will make off like bandits. With an average production cost of $5 per barrel, they will make a profit of $70 on every barrel at their inflated price, as compared to the $15 profit they would reap on each barrel at the free market price. True, their sales volume will be a bit lower, but their profit works out to $5.04 billion per day, about quadruple the profit that the free market would provide.

Figure 1 also vividly illustrates how weak conservation is as a strategy when deployed against OPEC. The dashed line with the triangle markings shows a new demand curve, moved somewhat to the left by a hypothetical global initiative that succeeds in reducing consumption worldwide by 5 percent. In a free market, this would result in a slight decrease in the oil price. But OPEC need only reset its quotas to get the price back to where it wants.

|

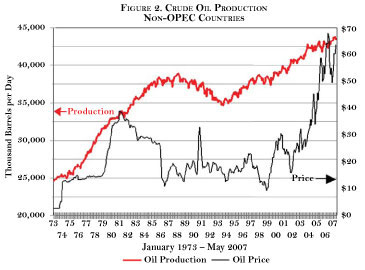

Source: WTRG Economics. Click to enlarge.

|

|

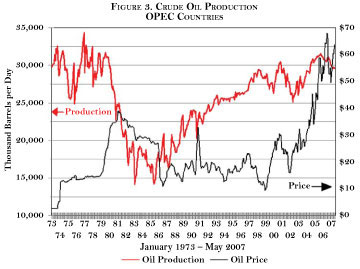

Source: WTRG Economics. Click to enlarge. |

In Figures 2 and 3, you can see the actual non-OPEC and OPEC production of oil from 1973 to mid-2007, set against the inflation-adjusted oil price. It will be observed that the non-OPEC production (shown in Figure 2) follows a fairly smooth curve, but that the OPEC production (Figure 3) varies wildly over very short time periods. These twitches in OPEC production are caused by the decisions of OPEC ministers to arbitrarily adjust their quotas to drive up prices.

For example, look at the years from 1998 to 2007. Non-OPEC production rose slowly through this period. But between 1998 and 1999, OPEC dropped its production from 29.5 million barrels per day to 26.3 million barrels per day, a move that sent the price surging from $10 per barrel to $30 per barrel. Then, after jacking their production back up to 30 million barrels per day to take in the profit from the higher price (a move which caused prices to drop back to $15 per barrel in 2002), OPEC cut production again, all the way back down to 25 million barrels per day, sending the price soaring again.

OPEC is effectively led and controlled by the Saudis. They have this control because they are the owners of the largest oil-export capacity and because, at $1.50 per barrel, their oil is the cheapest to produce. This fact gives them the whip hand over all the other OPEC members. If the other OPEC players try to cheat against their quotas (which they all like to do once the price has been run up), the Saudis can punish them by expanding production to crash the price. Since the Saudis’ oil is so cheap, they can still make plenty of money at $20 or even $10 per barrel, but most other OPEC member states would be hit hard. Thus the Saudis enforce discipline upon the cartel. Notwithstanding occasional grumbling, the other members willingly accept this discipline because they all know that it is necessary for the cartel to succeed in its mission of maximizing prices. Some non-OPEC nations, including Mexico, Russia, Oman, and Norway, frequently choose to march in step with the Saudis for the same reason, thereby even further expanding OPEC’s influence on the world’s oil markets.

It should be noted that these actions by OPEC were, and are, illegal. Collusion by suppliers to fix prices is not only a crime under U.S. law, it is banned by international law. The rules of the World Trade Organization (WTO) contain antitrust provisions that prohibit member states from setting quota restrictions on imports and exports. The WTO outlaws conspiracies to fix markets, and permits member nations to prosecute all parties to such conspiracies. (Saudi Arabia and seven of the other OPEC member states are WTO members; the rest — Iraq, Iran, Libya, and Algeria — are WTO observers.) The U.S. Justice Department would thus be entirely within its rights to initiate prosecutions against OPEC principals with interests in the United States (for example, Saudi royals), as well as against corporations, such as international oil companies, found to be acting in concert with OPEC. In addition, the imposition of retaliatory trade measures against OPEC nations would be fully justifiable.

Defending the OPEC Swindle

OPEC’s malefaction, however, is more than just a legalistic matter — it is a moral issue as well. Consider the following: During 2005, as a result of OPEC price-fixing, Saudi Arabia’s oil business reaped that country’s rulers over $150 billion, to be spent on a combination of profligate waste, influence-buying, and the international propagation of Islamist ideology. Simultaneously, Kenya, a nation whose population of 37 million is half again as great as that of Saudi Arabia, managed to scrape up around $2.5 billion in export earnings, and then had to use these precious funds to buy grossly overpriced but badly needed fuel (from Saudi Arabia and other OPEC states), with only a pittance left to purchase farm machinery, replacement parts, and other vital equipment. Kenya, incidentally, is not even one of the world’s fifty poorest nations; there are many others much worse off.

The injustice of this is appalling. It is one thing to be forced to pay $75 per barrel for oil when you make $20 per hour. It is quite another when you make $3 per day. OPEC’s price-fixing amounts to a viciously regressive tax on the entire world population.

Despite this, two groups of spokesmen have surfaced in the West to tell us that OPEC’s banditry should be gratefully accepted because it really serves the common good of all humankind. According to the first of these schools, OPEC is a blessing because the world is allegedly running out of oil, and by raising the price, the wise men of the cartel are helping us all to conserve.

Now it is true that raising the price of oil will tend to cut consumption, but not by much. Oil demand is very inelastic — it takes enormous price increases to effect any significant change in consumption. If we accept the demand curve hypothesized in Figure 1, we see that a cut in oil consumption from 85 to 70 million barrels per day (an 18 percent reduction) needs a near quadrupling of the oil price to be enforced. The real historical data shown in Figure 3 suggests that the situation is far worse — the quintupling of oil prices since 2001 was implemented by OPEC simply by cutting 5 million barrels — or 7 percent — out of the oil supply. During the same period, sales of cars with low gas mileage, such as SUVs, continued to grow without missing a beat. If we actually wanted to enforce global petroleum conservation through price increases, we would have to raise costs several hundred dollars per barrel. That would give the Saudis control of the world.

Fortunately, however, the claim that the world is running out of oil has no foundation whatsoever. Such claims have been made repeatedly in the past, and all have proven false. For example, as Learsy notes in Over a Barrel, in 1874, the state geologist of Pennsylvania, then the world’s leading oil producer, estimated that the United States had only enough oil for another four years. In 1914, the Federal Bureau of Mines said we had only ten years of oil left. In 1940, the bureau revised its previous forecast and predicted that all our oil would be exhausted by 1954. In 1972, the prestigious Club of Rome, using an inscrutable but allegedly infallible M.I.T. computer oracle, handed down the ironclad prediction that the world’s oil would run out by 1990. The club said at that time that only 550 billion barrels were left to humanity. Since then we have used 600 billion barrels, and are now looking at proven reserves of a trillion more. There is little new about today’s fascination with “peak oil”; since 1972, there have been repeated predictions of imminent oil-supply exhaustion published every few years by various authorities, and not one has come true. In fact, if we look at the ratio of proven reserves to consumption rate, the world has a bigger oil supply today than it ever has at any time in the past. The argument that we are threatened with near-term oil exhaustion is simply untrue.

While it has no substantial scientific data to back it up, the “running out of oil” argument is nevertheless supported by a Malthusian faith that holds that since the world’s resources are more or less fixed, population growth and living standards must be restricted or humankind will inevitably descend into bottomless misery. Because this ideology provides a rationale for cutting consumption by the most vulnerable, it has historically been used to justify various kinds of extreme exploitation, OPEC’s global looting being only the most recent example. However, as a scientific theory, Malthusianism is bankrupt and all predictions based upon it have proven wrong. As the world’s population has increased, the standard of living has increased, and at an accelerating rate. The pompous Malthusians of the Club of Rome had their surefire computer predictions of resource exhaustion proven wrong not just for oil but for every single commodity or mineral they discussed, and all for the same reason: they failed to account for the power of human creativity. In the case of oil, we have invented a host of technologies for discovering and developing vast petroleum reserves that were simply impossible to find or recover in 1972. There is every reason to believe that this trend will continue, as most of the world, including nearly all of the sea floor, remains unexplored.

By contrast, the other group of OPEC defenders argues that even though the world is not running out of oil, the oil companies need a financial incentive to look for and develop it — and so by dramatically raising the price, OPEC is doing its level best to make sure that there will always be plenty of oil for everyone. This is essentially the argument made by Peter Tertzakian, an economist for ARC Financial (an oil investment firm), in his otherwise intelligent 2006 book, A Thousand Barrels a Second.

The fallacy of this argument is that while it is no doubt true that a high oil price will encourage increased exploration, the amount of exploration produced by the increased price is in no way commensurate with the magnitude of the global tax that it imposes. At jacked-up prices of about $75 per barrel, the world’s oil producers pulled in about two trillion dollars during 2006, instead of the $500 billion or so they would have obtained in a free market. How much of that extra $1.5 trillion do you suppose they will invest in oil exploration? No one knows for sure, but the correct answer is probably under two percent.

In short, the OPEC-inflated oil price is simply a swindle. It does not benefit the world by preserving petroleum, and it is not necessary to encourage oil exploration. It is just a way to loot the world and radically expand the power of a group of cultists bent upon our destruction. There is no reason for us to tolerate it.

That said, how do we beat it?

Conservation and CAFE

When the subject of fighting OPEC comes up, the foremost proposal generally advanced is conservation. Since OPEC is taxing us by selling us oil, the thinking goes, we should simply use less. It sounds very sensible — but it is completely unworkable. It needs to be discredited because it proposes a strategy that guarantees defeat.

There are essentially just three ways to convince people to conserve: economic incentives, moral persuasion, or governmental action. None will succeed in this instance.

The most powerful persuader of the three is economics. Yet that is impractical here, because the objective is to reduce OPEC’s profits. If the oil price is allowed to soar high enough to induce conservation, OPEC wins big.

The notion of using moral exhortation to urge people to conserve is very nice, but as a practical strategy for reducing global oil consumption, let alone outmaneuvering OPEC, it is laughable. Whenever this idea is suggested, I am reminded of the feckless Whip Inflation Now (WIN) campaign launched by Gerald Ford’s administration in 1974 to counter retail price hikes. Alternatively, you might think of it as comparable to an attempt to alleviate world hunger through having church leaders call upon their congregants to eat less. A more serious approach is required.

That leaves the possibility of government mandates. These can certainly have some effect within the territorial jurisdiction of the United States — but the demand for oil is a global issue. No practicable U.S. government conservation initiative could lead to domestic consumption reductions large enough to influence the global oil price.

To be realistic as an energy strategy, a plan must be technically practicable and politically feasible. In the world of oil conservation ideas, the primary such candidate is the proposal to increase the standards for motor-vehicle mileage.

Approximately half of all American oil use is in motor vehicles, so cutting the amount of oil used in the transportation sector would seem to be a good place to start if one wanted to conserve oil. Moreover, there is a partial record of historical success with this kind of conservation. In 1975, the U.S. Congress imposed the Corporate Average Fuel Economy (CAFE) standards on the auto industry. Those standards were met, and as a result, between that year and 1990, average American automobile fuel economy rose from 13 miles per gallon to 20 miles per gallon. Despite this remarkable achievement — an achievement, incidentally, substantially augmented by a major U.S. economic slowdown between 1974 and 1983 — U.S. gasoline consumption still increased from 89 billion gallons per year in 1975 to 103 billion gallons per year in 1990. And worse, the engineering mileage improvements accomplished between 1975 and 1990 were the low-hanging fruit — the obvious ones. Since 1990, there has been no significant increase in vehicle mileage, and oil consumption has continued to rise, reaching 140 billion gallons per year in 2005.

It is true that, if it weren’t for CAFE, the rise in gasoline consumption would have been even worse. But the point is, CAFE didn’t stop OPEC. Far from it. Despite CAFE and comparable (or even more forceful) measures introduced in many other countries, world oil consumption rose from 50 million barrels per day in 1975 to over 70 million barrels per day today.

Still, even though it is hard to imagine how we could repeat CAFE’s 1975-1990 success, let’s say we could. This would imply raising average vehicle mileage from today’s 20 miles per gallon to about 31 miles per gallon. Then, over the next fifteen years, instead of U.S. gasoline consumption rising to 190 billion gallons of gasoline per year (requiring an additional 5.7 million barrels of oil per day to produce), it would only be expected to rise to 162 billion gallons of gasoline per year (requiring an added 2.5 million barrels of oil per day). In other words, duplicating CAFE’s achievement would not cut our oil consumption at all. It would only reduce our expected rate of increase of oil usage by 2.2 million barrels a day, during a period when the world as a whole is likely to raise its consumption another 30 million barrels per day. Whatever demand we eliminate would be replaced fifteen times over. OPEC will keep profiting handsomely.

It is worth dwelling for a moment on the magnitude of the rising worldwide demand for oil. Even though oil prices have quadrupled over the past six years, the rate of rise of global oil consumption is accelerating, with recent annual increases of about 1.7 million barrels per day. Only about 11 percent of this rise is occurring in the United States; most of it — by far — is occurring in China, India, Eastern Europe, and Latin America. Everywhere the same pattern is repeating: Once people become wealthy enough to buy a car, they do so. Auto sales in China doubled between 2001 and 2003, and have doubled again since. They are going to keep doubling. In the United States today, 800 out of every thousand people own cars. In China the number right now is only 8 cars per thousand. There are a lot more cars coming. These developments promise to drive the price of oil through the roof.

In the fight against OPEC, conservation is a sure loser.

There was one other area of energy policy where the U.S. government did achieve some measure of success in reducing America’s petroleum dependence. This was in the field of electric power generation. In 1974, about 17 percent of all U.S. electricity was produced by burning oil and 18 percent from natural gas. However, as a result of the Carter administration’s Fuel Use Act, which discouraged this, by 1985, oil-fired generators supplied only 4.1 percent of U.S. electricity, and natural gas 12 percent. Today, though natural gas is back up to 18 percent, oil is down to 3 percent. The fraction of electricity that had been produced by burning oil has been replaced primarily by nuclear power, which went from 4 percent in 1973 to about 20 percent today.

The success of the Fuel Use Act is particularly remarkable in light of the fact that nearly all of the Carter administration’s numerous other energy initiatives were complete failures. Why did it work so well? The answer is simple: the Fuel Use Act was not a fuel conservation policy. It was a fuel substitution policy. There was no reduction in electricity use during the period in question. Far from it. In 1978, when the act was passed, the U.S. generated 252 million kilowatts of electricity; by 1986, by which time petroleum had been substantially removed from the mix, the country was generating 284 million kilowatts. By 2005, when oil had dipped to providing just 3 percent of American electricity, the country produced 443 million kilowatts overall.

There are two points to be made here. First, this achievement cannot be repeated. With petroleum all but gone from our electric power base, we can’t save significant additional quantities of oil by altering our electricity production or use. So, as conscience-soothing as they might be, windmills and solar panels will not help us fight OPEC. (They can, however, along with nuclear power, indirectly assist matters by playing a role in methanol production, as discussed below.) The second point, however, is much more important: conservation fails, but substitution works. Indeed, while it takes a huge price hike to reduce energy use, it only takes a small edge to cause a shift from one energy source to another. This is the key insight needed to beat OPEC: we need to switch the world to a different fuel.

Getting Away from Oil

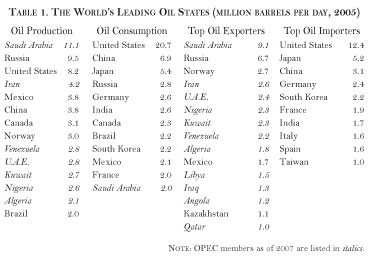

Oil is the dominant fuel today because only oil can currently provide energy in the liquid form necessary for powering practical motor vehicles and aircraft, and most desirable for driving ships and trains. These vehicles are the sinews of our economy and the fundamental instruments of our military strength. Our dependency on oil puts the United States in a weak position internationally. Table 1, which lists the world’s leading oil producers, consumers, exporters, and importers, makes this clear. If you look at the production column at the left, the American position seems reasonably strong — the United States is the world’s third largest oil producer. But because the United States is also — by far — the world’s largest oil consumer, we import more oil than we produce domestically. As the net import/export balances in the two columns at the right indicate, the United States is in the worst position, importing more oil than the next three biggest importers combined.

|

|

Click to enlarge. |

The top exporter, of course, is Saudi Arabia. What’s more, the list of oil exporters shows something else very significant about the global oil supply. All the OPEC members are listed in italics. Note how much more Saudi Arabia exports than all the other OPEC members. The rest of the gang each export between one and three million barrels of oil a day. The Saudis export over nine — more oil than the next three OPEC members combined. They are head and shoulders the leader of OPEC, and in fact, without them, the gang would have no clear leader.

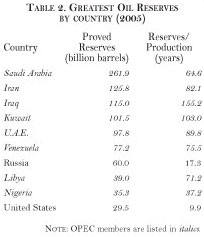

The dismal American position is made even clearer if we consider the matter of petroleum reserves, as illustrated in Table 2. Now it is quite true that new oil reserves are always being discovered, so despite the calculated reserves/production ratios presented in the right column, you should not expect the United States to run out of oil in 9.9 years. Nevertheless, the fact that the OPEC nations (again shown in italics) have reserve/production ratios so much higher than the United States is gravely significant. We will tap out first. If they are beating us badly today, in the future they will simply trample us into the ground.

|

|

Click to enlarge. |

In regard to other energy sources, the United States is much better positioned. The U.S. has greater coal reserves than any other country on the planet — more than a quarter of the total global reserves — and produces more coal each year than any country but China. Much the same is true for natural gas: North America is now roughly self-sufficient, unlike Europe (which heavily depends on Russia to make up its shortfall) and Asia (which draws significant imports from the Middle East). And although good statistics are hard to come by, it seems clear that biomass is another fuel that North America could produce plentifully.

None of these fuels is on an equal footing with oil because none of them is currently used to produce liquid fuel for transportation. But what if we could convert them into usable liquid fuel?

In point of fact, we can. No new Manhattan Project will be required to discover how. The chemical knowledge required to do it is quite well established, being hundreds, and in some cases thousands, of years old. All we need to do is make alcohol.

There are many different kinds of alcohols, and all may be used as fuels. However, for our purposes here, the two most important alcohols are the two simplest: ethanol and methanol. Ethanol is the kind of alcohol we drink. It has been made since prehistoric times by using microorganisms to ferment the sugar and starch content of plant material. Over the millennia, humans have made alcohol by fermenting grapes, honey, wheat, barley, rice, sugar, molasses, apples, pears, potatoes, corn, and many other crops, each into its own characteristic drink. Basically, if it’s a plant and you can eat it, you can make booze out of it. The sweeter it is, the more ethanol you will get. This is why sugar cane is the most economical way to produce ethanol, but almost any crop with a high caloric value will do. Thus, in recent years in the United States, a major ethanol industry has been created — with the support of modest government subsidies — based on the conversion of corn. Corn, however, also contains much protein and other nutritional components not used in ethanol production. In most commercial corn-to-ethanol plants in America today, these components are saved and processed for sale as animal feed.

That said, the food crops used as a basis for ethanol production through this technique have significant commercial value, and that puts a floor under the production cost of fermentation-based ethanol. For sugar, that cost is about $1 per gallon, while for corn it is around $1.50 per gallon (without any subsidy). Ethanol has about two-thirds the energy value per gallon as gasoline, so these prices correspond to gasoline sold at $1.50 and $2.25 per gallon, respectively (before taxes — most gasoline sold in the United States is taxed about $0.50 per gallon). These gasoline prices, in turn, correspond to oil priced at $36 and $54 per barrel. So long as oil is pegged above this level (as it currently is), crop-fermentation ethanol can beat the price of gasoline. Should the price of oil drop back below such levels, some combination of tariffs, subsidies, or preferential taxes would be required to keep crop-fermentation ethanol competitive.

Only fractions of the plants that farmers grow are actually sold as commercial crops. Large quantities of vegetative material, such as the stems, roots, and leaves of corn plants, for example, are left to waste. This is also true of tree leaves that are discarded in the fall, and vast quantities of grasses and weeds that grow, yellow, and fade every year without being eaten or otherwise used by man or animal. If this material could be turned into ethanol, its price and availability would improve radically. Much of this material, however, is primarily cellulose, which cannot be readily fermented into ethanol. For this reason, considerable research is currently underway around the world to try to discover or engineer some microorganism that can transform cellulose into a starch or sugar, which would thus be fermentable. In principle this should be possible, because grazing animals such as horses, deer, and cattle perform this trick in their stomachs all the time — this is why they can eat leaves. However, isolating the bacteria or enzymes that perform this chemistry for the grazers and getting them to serve humanity in the same capacity in an industrial setting has proven a challenge. Eventual success for cellulosic ethanol technology appears highly probable, but we don’t have it yet.

Fortunately, however, there are simpler techniques to make usable alcohol fuel out of biomass, and much else. This brings us to methanol, the simplest liquid fuel molecule known to chemistry. Commonly called “wood alcohol” because it can be readily produced from wood, it can also be manufactured out of virtually any kind of organic material, including every kind of biomass (whether edible or not), as well as coal, natural gas, human and animal metabolic wastes, and municipal trash. Since its potential sources are so vast, varied, and cheap, methanol promises to be an inexpensive fuel. In fact, it already is: during the summer of 2007, the wholesale price of methanol, manufactured and sold without a subsidy, was $0.93 per gallon. Methanol has about 54 percent the energy density of gasoline, so this price is the equivalent of gasoline selling for $1.70 per gallon (before taxes).

Depending upon the source material, there are a number of different ways to make methanol, but they all come down to the same few chemical reactions. Converting coal or natural gas to methanol can be done with tried and true nineteenth-century chemical engineering. The same goes for biomass — which means that any plant material, without exception, from weeds and fallen leaves to swamp cattails and the vast floating growths that clog innumerable rivers in Latin America and Africa, can be used as feedstock for the process. And trash, too, can be converted to methanol: it doesn’t matter whether the feedstocks are packaging materials, old rags, used candy wrappers, plastic forks, or Styrofoam coffee cups; the stuff is all just compounds of carbon, hydrogen, and oxygen, with a few impurities thrown in here and there, and all of it can be converted to methanol.

The chemistry needed to dethrone oil is well understood. We can readily convert our available fuels into an alcohol supply bountiful enough to displace a large portion of the oil we import. The only problem is, we need to have cars and trucks that can use it.

The Technology to Break OPEC’s Chains

There is no Nobel Prize for engineering. The closest thing to it is the Charles Stark Draper prize awarded by the U.S. National Academy of Engineering. Not as famous as the Nobel, the Draper is still rather prestigious, and comes with a $500,000 check. Those so honored have included the inventors of the turbojet, the integrated circuit, and the Internet — and collectively represent a roll call of the creators of the modern technological age. No woman has ever won it. There is, however, one who should have.

Her name was Roberta Nichols. Born in 1931, her dad was an engineer at Douglas Aircraft, and despite the near total exclusion of women from engineering schools in her day, she saw no reason why she couldn’t become one as well. Working with her father, she repaired vintage automobiles, and built and piloted racing cars and boats. “I just grew up not knowing that girls weren’t supposed to like to do those kinds of things,” she said many years later. So she became an engineer, and a very good one, too. Her passion was the internal combustion engine, and after a pause to have and raise children, her career advanced rapidly. By the late 1970s, she was leading the research in alternative-fuel vehicles at Ford.

The time was certainly right for a talented inventor of alternative-fuel cars. The United States had received a massive blow from the first Arab oil embargo, and was about to receive a second shock following the revolution in Iran. During the 1970s, numerous government committees had met, conferred, and issued reports, all converging on the view that America needed an alternative to foreign oil, and that methanol could well be the best answer. The environmental movement was also waxing, adding new force to the issue of air pollution, particularly in southern California. Again, methanol vehicles appeared to be a solution.

Nichols had grown up in Los Angeles, graduating with a bachelor’s degree in physics from University of California at Los Angeles, and then obtaining advanced degrees in environmental engineering from the University of Southern California. She had played a formative role in launching the California Energy Commission (CEC), and had many friends among the environmentalists who ran it after her departure for Ford. Working with these contacts, she sold the state government on the idea of launching a major program to prove the practicality of methanol-powered automobiles. Then she went back to Ford and fought an internal campaign to get the company to invest in the project. To prove that methanol cars could work, she single-handedly converted a Ford Pinto to methanol. Overcoming significant opposition, she got her way.

The experiment began in 1980, with Ford supplying twelve specially designed methanol-fueled Pintos to the state government. By 1983, California was operating over six hundred methanol-fueled cars, including an impressive fleet of 561 Ford Escorts.

The methanol vehicles were a great technical success. Methanol is 105 octane fuel, and its use in pure form in the California state fleet cars increased their effective horsepower by twenty percent. As Nichols recalled in one of her last papers, “the drivers loved the performance.” The cars had good fuel-efficiency ratings and advanced emission standards, too. Overall the methanol fleet racked up some 35 million miles of real-world travel, and came through with flying colors. Indeed, by 1990, after seven years of use and abuse, over 90 percent of the original methanol Escorts were still running strong.

There was, however, a problem. Methanol only contains about half the energy per gallon as gasoline, so even though the methanol engines were 15 percent more efficient in using this energy, the distance traveled per gallon was only about 57 percent of that attainable with gasoline. Ford tried to compensate by increasing the size of the fuel tank, but there were limits to how much capacity they could add given the fact that they were retrofitting an existing car model. As a result, the methanol Escorts could only travel about 230 miles before refueling. Such a range limit would only be a minor inconvenience for a gasoline vehicle, because there are gasoline stations everywhere. But California had only twenty-two methanol refueling stations statewide. As Nichols put it: “It was clear that this number of stations was totally inadequate for the drivers of these vehicles to feel comfortable. They had to constantly monitor the fuel gauge and carefully plan their routes.” Furthermore, with only six hundred methanol cars operating in a state with over 10 million gas-fueled vehicles, private gas-station owners had no incentive to waste any pumps on methanol. In short, there weren’t enough methanol stations to induce anyone other than the CEC to buy methanol cars, yet unless there were a million or more methanol vehicles on the road no one would build methanol stations. This chicken-and-egg problem was a showstopper. The methanol car was a technical success but a technological dead end.

In retrospect, the need for operational infrastructure to support the methanol vehicles may seem obvious, but the engineers wanted to make cars that work and the environmentalists wanted to make cars that wouldn’t pollute, and so for the Ford/CEC team, achieving technical success with the cars was the first priority. But having accomplished that, they were faced with the brutal reality that for a new technology to make its way into the world, intrinsic merit is not enough. In engineering, as in politics, nothing is so difficult or so perilous as the creation of new modes and orders, and an infant invention that hopes to do so is confronted by technical and economic realities that have been shaped not by its own needs but by those of the technologies it aims to usurp. Before a new technology can change the world, it must live and grow to power within the world as it is. The methanol cars might be a driver’s delight, but unless they could function in a world without ubiquitous methanol stations, they would forever remain a footnote — just one more curious hobby-horse technical demonstration instigated and toyed with for a little while by eccentric bureaucrats and playful engineers with other peoples’ money to spend and nothing better to do with their time. That was not the fate Nichols intended for her project.

There was only one answer. To make their way into the economy in numbers that weren’t trivial, the methanol cars would also have to be able to run on gasoline.

Now, the technical issues associated with building methanol-only cars are not particularly great. Methanol is more corrosive than gasoline, so superior quality materials need to be used in the fuel line. A methanol engine burns with more fuel and less air than gasoline, so the fuel and air inputs for the engine need to be set accordingly. Methanol is a bit harder to ignite than gasoline, but burns cooler and cleaner, and its high octane offers the opportunity to achieve an increased compression ratio, higher fuel efficiency, and better vehicle performance. These considerations variously complicate and ease the designer’s task, but at the end of the day, an engineering team attempting to develop a methanol-only automobile is faced with a technical challenge roughly equivalent to that involved in creating a good gasoline-powered vehicle. In fact, in the 1960s, many drivers, including Nichols, had independently converted their racing cars to methanol, preferring it for its safety advantages and higher octane. (Methanol was actually the fuel of choice for Indianapolis 500 race-car drivers for more than three decades, although Indy cars switched to ethanol-only in 2007.)

Creating a mixed-fuel car, however, is another question altogether. It would not be a particularly difficult challenge if the designer could be informed in advance that the car would run on some specified mixture, say 40 percent methanol and 60 percent gasoline (M40). But for a methanol/gasoline car to do what the Nichol’s team now realized it really needed to do, it would have to be able to run on any arbitrary mixture. A car might start out the day with a full tank of methanol (M100), and then fill up with gasoline when the tank was three-quarters empty. From that point on, it would be running on M25, until it refueled again, at which time its fuel mixture would change unpredictably to something else. The challenge was baffling. How can one possibly design an automobile engine to work well without knowing what fuel it is going to use? The only way to do it would be to have an engine that could actively change its behavior in immediate response to the quality of its fuel. But how?

An opening was provided by the Dutch inventor G. A. Schwippert, who in 1984 patented an optical sensor that could determine the alcohol content of a methanol/gasoline mixture by measuring the fluid’s index of refraction (light-bending properties). Using this device and the new technology of electronic fuel injection then coming into general use, Nichols and her Ford team devised a scheme whereby a Schwippert sensor would assess the alcohol content of the fuel in real time as it was being fed to the engine. The computer that controlled the car’s electronic fuel injector (EFI) would then determine the correct air/fuel ratio for the mixture of the moment. No matter what the fuel mixture might be, the EFI would always know how much to pump to make the engine operate correctly.

It was a breakthrough. This design concept represented the first complete practical system to enable an automobile to run omnivorously on any mixture of alcohol and gasoline. Nichols and her colleagues had invented the flexible-fuel vehicle (FFV).

Nichols lost no time in putting her team’s invention into practice. In 1986, even before the ink on the patent applications was dry, she rushed an experimental methanol/gasoline flex-fuel Ford Escort to the CEC for field testing. The next year she followed with seven methanol/ethanol/gasoline flex-fuel Ford Crown Victorias, and in 1989, sent 183 more. This was just the beginning. The flex-fuel cars were so successful that in the early 1990s Nichols was able to get Ford to launch a full production run, and some 8,000 methanol/gasoline flex-fuel Ford Tauruses were shipped to California. For the first time, many of the cars were bought by the general public.

Realizing that something important was going on, the other auto manufacturers roused themselves and created their own flex-fuel concepts. By the end of the 1990s, General Motors had shipped the CEC 1,512 methanol/gasoline flex-fuel vehicles, Chrysler sent 4,730, and there were a handful of Volkswagens, Nissans, Toyotas, and Mercedes-Benzes.

The cars worked well. As the CEC’s Tom MacDonald reported in a summary paper on the program published in 2000, the over 14,000 methanol/gasoline FFVs demonstrated “seamless vehicle operation on methanol, gasoline, and all combination of these fuels.” He also noted that FFV engines were as durable as standard gas engines and that there were incremental improvements in emissions fuel efficiency.

FFVs are also better for the environment than gas-powered cars. In the 1970s and 1980s, when the environmental argument for methanol conversion was first made, it centered upon the superior potential of alcohol fuels for mitigating the immediately pressing problems of air pollution and toxic spills, both on land and on water. Unlike oil, gasoline, kerosene, and virtually all other petroleum fuels, alcohol fuels can mix with water. They dissolve and are readily consumed by common bacteria, which averts long-term environmental degradation. Today, nearly two decades after the Exxon Valdez oil tanker disaster devastated 1,200 miles of coastline, thousands of sea otters are reportedly still being poisoned by eating polluted clams. If, however, the Exxon Valdez had been carrying alcohol instead of petroleum when it wrecked, the threat to wildlife would have been rendered harmless within hours, or days at most, and the past occurrence of the event would have been made undetectable within months. These same considerations hold with respect to possible seepage into ground water of methanol or ethanol from defective pumping stations, crashed or abandoned automobiles, wrecked tanker trucks, leaky lawnmowers, or any other land-based source. On many lakes frequented by recreational power boats today, an iridescent petroleum scum dangerous to wildlife and obnoxious to swimmers can be observed. If those power boats were running on alcohol, that pollution would not exist.

Our use of gasoline poses health risks, too. According to the Environmental Protection Agency, smoke, soot, and other particulate pollution from cars currently causes approximately 40,000 American deaths per year from lung cancer and other ailments. And as a result of fuel leaks and spills, incomplete combustion, and fumes from ordinary refueling operations, vast amounts of carcinogens and mutagens are released every day, causing an increased incidence of cancer among the general public. The result is many deaths and billions of dollars in health-care costs inflicted on the nation every year. Alcohol fuels do not produce smoke, soot, or particulates when burned in internal combustion engines, and neither methanol nor ethanol causes cancer or mutations.

To these classic environmental and health issues, more recent times have added the longer-term worry of global warming. Here, too, alcohol fuels can help. Ethanol is made from plant material and methanol can be. Since plant material is derived from carbon dioxide drawn from the atmosphere, burning it causes no net increase of atmospheric carbon dioxide. (Methanol made from natural gas that would otherwise be vented or flared, or from municipal waste that would otherwise be decomposed by microbes, is also global-warming neutral.) In addition, the very act of growing plants acts as a powerful mechanism for active global cooling, and so the promotion of agriculture for the production of alcohol fuels can contribute to fighting global warming.

But beyond the CEC’s successful pilot program, there has been very little interest in FFVs. The farm lobby has pushed for them as a means to expand ethanol sales, which is why, for the past decade or so, FFVs have been designed primarily for ethanol use. All told, some six million FFVs have been produced to date in America — a number that sounds impressive, and that indeed is quintuple the number of gas/electric hybrid cars in the United States today, but is still dwarfed by the total U.S. fleet of about 230 million cars now on the road.

Roberta Nichols died of leukemia in 2005, her dream for flexible-fueled cars still unachieved, but perhaps, for someone with vision as far-seeing as hers, finally in sight. One cannot help but admire her life and her accomplishment. Personally, I find especially delightful the historical irony that fundamentalist Islam, which detests uppity women, nonconformists, innovators, and liquor, should ultimately face its comeuppance from the brainchild of a gutsy mold-breaking inventress with unshakeable faith in the power of alcohol.

The Time for ActionAlcohol FFVs are proven systems. They can be manufactured for approximately the same price as gasoline cars, they pollute much less, and they are significantly safer. The only sticking point preventing the United States from rapidly transferring to alcohol fuels is the unavailability of high-alcohol fuel mixes at the pump. Filling stations don’t want to dedicate space to a fuel mix used by only 3 percent of all cars. And consumers are not interested in buying vehicles for which the preferred fuel mix is extremely difficult to find.

The only way to break the monopoly on the vehicle fuel supply currently held by OPEC is through legislation. Congress should require that all future vehicles sold in the United States be flexible-fueled, capable of using mixtures of methanol, ethanol, and gasoline. Within three years of such a mandate, there would be 50 million such FFVs on American roads. This will, in turn, force all automobile manufacturers abroad to switch to FFVs as well, thereby creating a huge global market and infrastructure for alcohol fuels. Even with methanol in the mix, the vastly increased demand for alcohol fuels will exceed the supply capacity of American ethanol producers, which means that we could end our current tariffs against ethanol from Latin America. Europe and Japan, too, would likely drop their protectionist measures against agricultural imports from developing countries. Not only would Third World farmers have new markets for their products, but they would also benefit from the collapse of petroleum prices and would have the wherewithal to buy more manufactured goods from developed nations.

There is recent precedent overseas for a successful switch to alcohol fuels. Lawmakers in Brazil decided in 2003 to engineer a national transition to FFVs, using tax incentives to help move things along. As a result, the Brazilian divisions of Fiat, Volkswagen, Ford, Renault, and GM all came out with ethanol FFV models in 2004, which accounted for 20 percent of the country’s new vehicle sales that year. By 2006, about 70 percent of all new vehicles sold in Brazil were FFVs, and in 2007, the flex-fuel auto market share is projected to approach 90 percent, and it will reach 100 percent fairly quickly since all non-flex-fuel lines are being phased out. This has produced significant fuel savings to consumers, a boost to local agriculture, and a massive benefit to the country’s foreign trade balance. Coupled with the country’s aggressive program of offshore oil exploration, the switch to FFVs has allowed Brazil to become energy independent.

So what’s stopping FFV legislation from becoming reality in the United States? There have been a few half-hearted attempts in Congress in recent years, but in the absence of any significant support from the president, these bills have gone nowhere. And why doesn’t the White House support FFVs? In March 2006, I discussed this proposal with John H. Marburger III, the president’s science advisor. He asked me a number of detailed questions about the FFV proposal, which I answered. I then asked him, “So why not implement the plan? If the president introduced a bill calling for a flex-fuel mandate, he’d get bipartisan support and the bill would pass. It would be a real accomplishment for the administration and for American energy independence.” Marburger answered: “We don’t believe in mandates.”

I subsequently met for two hours with one of Marburger’s senior staffers. While finding the idea of moving to FFVs interesting, he objected to the concept because it would cost the American auto industry a total of $150 million to make the necessary conversion. This is less than the United States spends on foreign oil every five hours.

Unlike other energy security proposals that call for strict conservation regimes or high gas taxes that would damage the economy, or that depend upon technological pipe dreams like the hydrogen car, a switch to FFVs is eminently practicable. And even though it depends on a government mandate to get the ball rolling, it is ultimately a market-based proposal: instead of subsidies or taxes, it relies on the creativity and hard work of individuals and corporations to open new markets; it will end the market-distorting machinations of the OPEC cartel by exposing it to competition from farmers and others around the world. Only in this way can we destroy the vertical monopoly which will otherwise continue to give the Islamists the ability to loot humanity through endless, unconstrained price hikes. But instead of taking the necessary bold first step, the administration apparently prefers — as Energy Secretary Samuel W. Bodman III has put it — “working on … the car manufacturers to undertake the manufacture” of FFVs voluntarily. “It’s just a matter of getting them to commit.”

Feeble attempts at persuasion aren’t sufficient. The time has come for action. We must take ourselves — and the rest of the world — off the petroleum standard. Only in this way can we transfer control of the future from those who take their wealth, pre-made, from the ground, to those who make their wealth through hard work, skill, and creativity (and thus build free societies). If we adopt a policy of deliberately growing the alcohol economy, we can make OPEC’s oil unnecessary. We will then be in a position to dictate terms to the terror bankers.

In a game of chess, the struggle ends not with the taking of the enemy king, but with his entrapment. If we could engineer a liberation from oil, the enemy would be rendered helpless, and one way or another, the oil-for-terror game will be finished.

Call it checkmate. Call it victory.