|

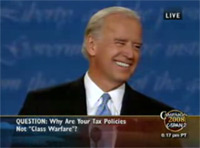

| Joe Biden: Distorting the facts. |

During the vice presidential debate yesterday between Senator Joe Biden and Alaska Governor Sarah Palin, the Democratic candidate repeated several misleading and outright deceptive arguments about the McCain health care plan that the McCain campaign needs to take on, and soon. At a minimum, Senator McCain needs to be ready to set the record straight during the presidential debate next Tuesday evening.

My EPPC colleague Yuval Levin has already written an excellent piece for National Review Online detailing the numerous deceptions.

But it’s worth repeating the basic accusation and why it is so patently untrue.

Biden and Obama want to leave voters with the impression that they are going to get a $5,000 tax credit from McCain even though health insurance costs $12,000 per family, on average. Where’s the additional $7,000 going to come from?

Here’s how it would really work.

Suppose a worker gets $50,000 in cash wages and $12,000 in health insurance.

Right now, he pays federal income taxes on the wages but not the health insurance. Let’s assume, for reasons of simplicity, that the tax rate he is paying is a flat 25% on his wages. He therefore pays $12,500 in federal income taxes. His after-tax, after-health-care income is $37,500.

Now, under the McCain plan, his employer keeps paying the premium, which is now counted as income to the worker. He therefore pays federal income taxes on $62,000, or $15,500.

But he also gets a tax credit of $5,000 for health insurance, which means that, all in all, he owes $10,500 in federal taxes, or $2,000 less than he does today. His after-tax, after-health-care income is $39,500.

If the worker decides to buy his insurance in the open market instead of through the employer, the result will be the same. His employer is indifferent to how he pays his worker as long as total costs are the same. So instead of paying premiums, the employer pays his worker $62,000 in cash wages and does not pay anything toward insurance. The worker again owes $15,500 in taxes on this compensation, and he also must buy health insurance costing $12,000. So, his pre-tax income is $62,000, he owes $12,000 in health insurance premiums, and he owes $10,500 in federal taxes (after claiming his credit). His after-tax, after-health-care income is the same: $39,500 ($62,000 – $12,000 – $10,500), or $2,000 more than today.

RELATED EARLIER POSTS:

– Dr. Obama (September 5, 2008)

– Governor Palin vs. Certificate of Need (CON) Laws (September 3, 2008)

– The Uber-Regulator (August 27, 2008)

– Employer-Based Health Coverage Threatened (July 1, 2008)